Saving Money on International Payments as a Remote Freelancer

As a remote freelancer you likely receive payments from other countries and convert these different currencies into your own currency.

These international payments and currency conversions often have hidden fees and unfavorable exchange rates which can cost you hundreds or even thousands a year.

Luckily for banks and payment providers, these fees are easy to hide so you don't even notice it.

After years of working remotely and receiving payments from companies in more than a dozen different countries, I've learned a lot about how to not lose money to these hidden fees, and I'll give a crash course on how you can do the same.

International Payments

The two main ways of transferring money internationally are by using international wire transfers between banks or by using a money transfer provider such as TransferWise, Paypal or Payoneer.

Both options have their pros and cons.

International Wire Transfers

Banks are very safe, they are bound to a lot of regulations and supervised by governments. In the unlikely even that they do go bankrupt, they are usually bailed out by governments.

They are also expensive and slow. Their fees for international payments are high and they do not give you the real exchange rates but add some extra margin on top.

It can take days or even weeks for the transaction to come through which might be a problem for the cash flow of your business.

Online Payment Providers

The last decade has spawned many new online payment providers. Their promises include lower fees, better exchange rates, faster transactions and easier to use than "normal" banks.

Most of them are not classified as banks and run without banking licenses and governmental oversight. They are more convenient and cheaper but definitely a little riskier as well.

Some well known examples of these are TransferWise, Paypal, Payoneer and Revolut.

How They Make Money

To understand how to save money on their fees, it's important to first learn how they make money. Because their profit is coming out of your pocket.

There are two ways companies make money on international transfers: charging fees or by 'padding' the exchange rate.

Fees

There are multiple fees like transaction fees processing charges which can be fixed fees per transaction or set at a percentage of the transaction. Fixed fees stay the same no matter if you bill 1k or 100k, percentage fees grow the larger your transaction.

When evaluating which option to use, people often make the mistake of just looking at the fees. A common trick is to advertise "0% commission" or "no fees". Seems like a great deal right? not quite.

Exchange Rates

The best way to make money on international transactions is by offering exchange rates that favor the processor.

When banks exchange currencies they use the interbank exchange rate or the "mid-market" rate. The midpoint between the buy and sell rate of a currency pair.

That is the rate you'll find on Google or services like XE and Reuters.

When they process your payment, they don't give you the mid-market rate but a rate that has some extra margin on top. Usually around 4-6%.

Let's Talk Numbers

Enough theory, let's see what all this means in the real world.

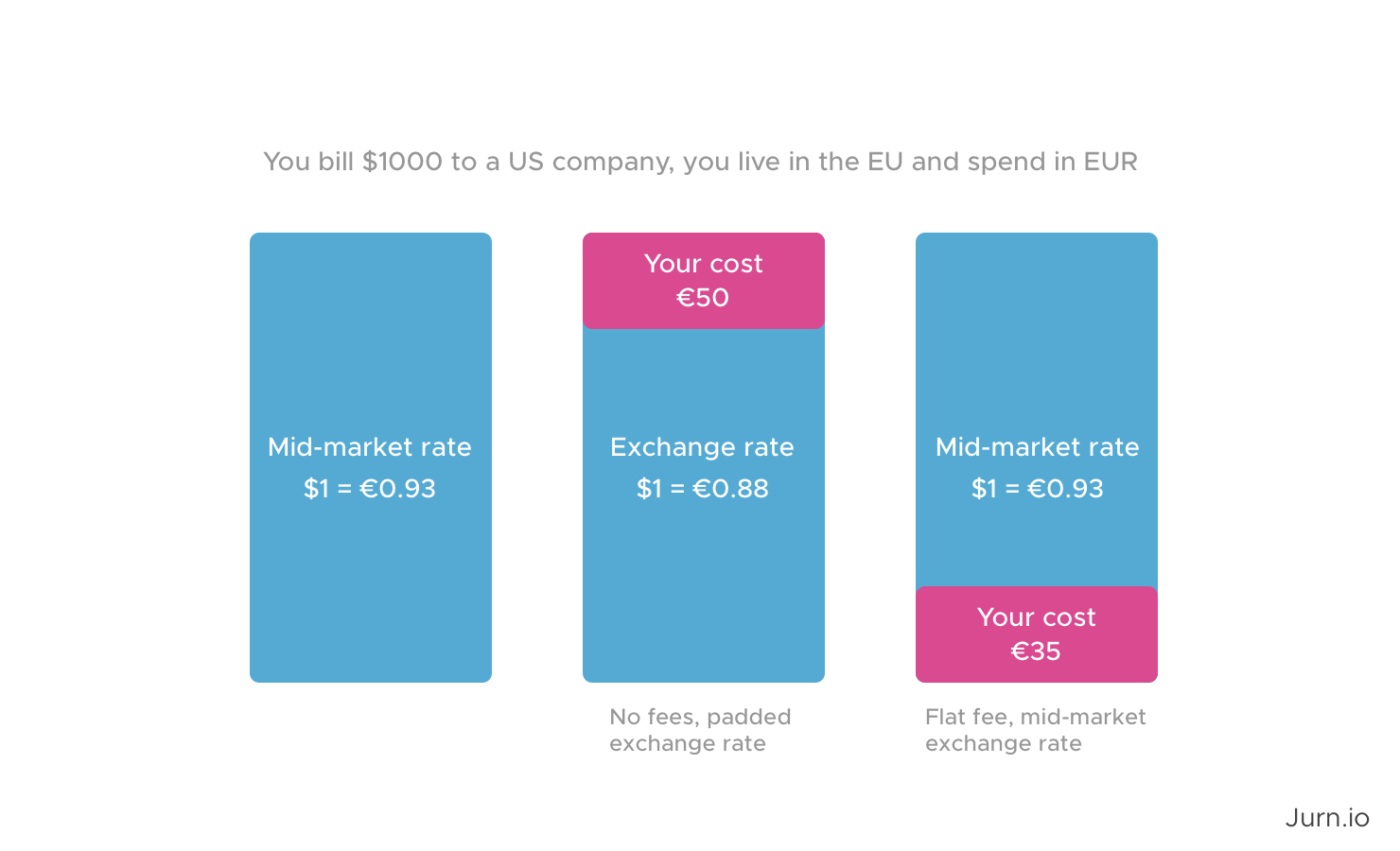

Let's say I'm in the EU and spend in Euro, I bill USD to a US-based company that I did some consulting for. I want to get the most Euros I can and have two choices.

One charges zero fees and one charges a (very high) flat fee of €35 but gives you the mid-market rate.

The one without fees seems like the obvious choice, you google the exchange rate and see it slightly differs but only by a few cents on the dollar. The few cents on the dollar seem obviously cheaper than paying €35 for one simple transaction.

No problem you think and you use the company that charges zero fees. Here is how that works out.

The "zero fees" company is more expensive to use than the company that charges you a €35 transaction fee just by giving you a better exchange rate.

Okay, so you could have saved €15. No big deal you think. You make €80.000 a year, you won't even notice it's missing.

But what if it's a 6-month project and instead of billing them 1000 per month, you are billing them 10.000 per month?

Now you could have saved €150 per month for 6 months, meaning you lost €900 just on currency conversion on this project. Ouch!

I won't bore you with the math but if you have multiple international clients, you quickly see how this adds up to hundreds or even thousands of euros per year.

It could very well be that you can buy a brand new MacBook Pro every few years with just the savings on your international payments.

Now that €15 seems like a much bigger deal doesn't it?

Adding an extra step

Since most banks charge fees and offer padded exchange rates, it's obvious how much money you could save by using one of these online payment providers.

But what about the risk? All these tech companies come and go, they usually don't have a bank license, don't have to follow the regulations that are in place for banks and their growth over profit mindset could end up bankrupting them.

Your bank is safer. It has a banking license, government oversight, financial reserves and your savings are covered under the deposit guarantee system in the EU. If they were to go bankrupt, the government would cover your savings up to €100.000.

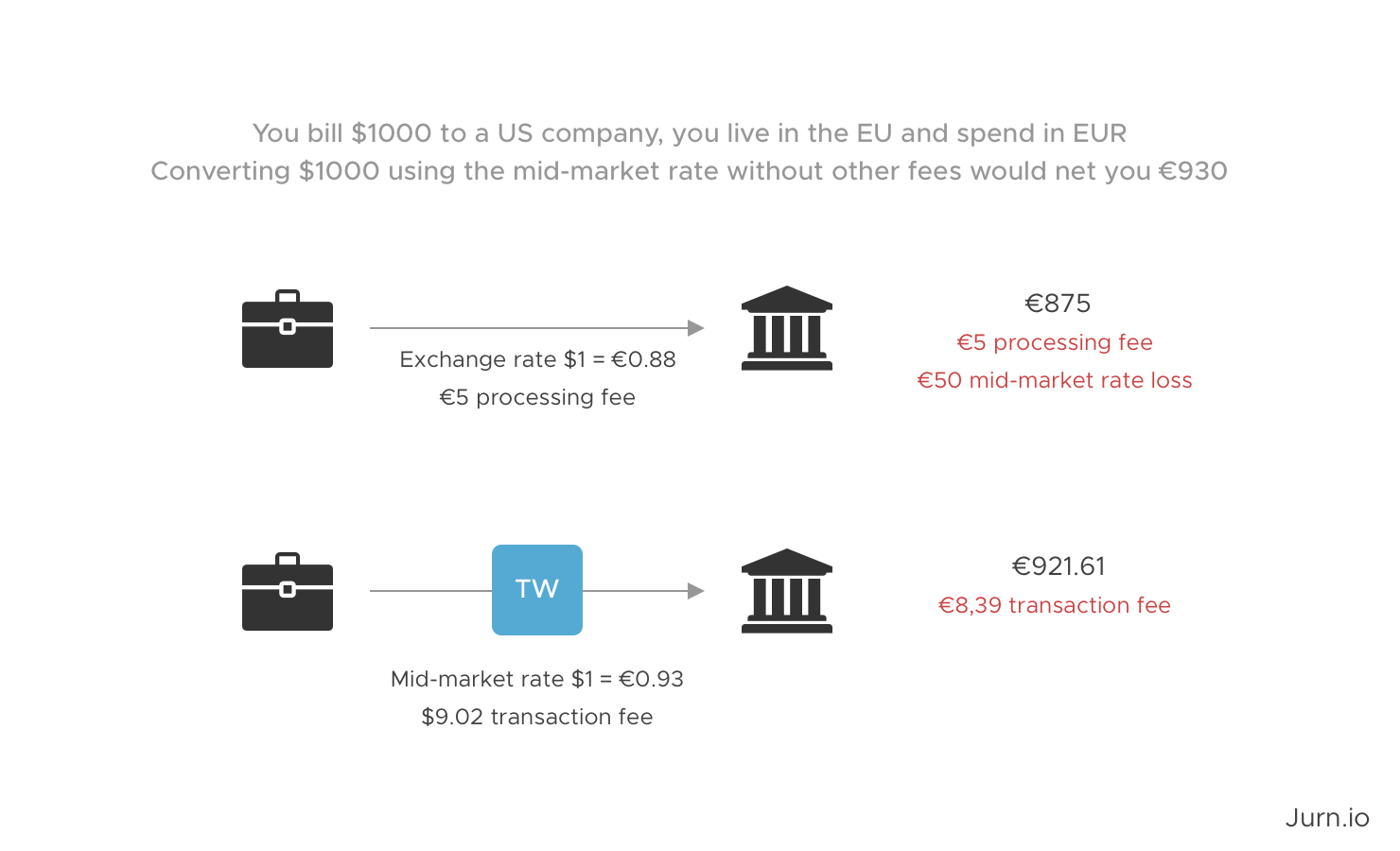

Luckily you can split the transaction in two parts and get the best of both worlds.

In this example we'll use TransferWise to receive the payment and then transfer it to our EU based bank.

As you can see, the money still ends up in the same place but we saved €46,60 in easily avoidable fees.

TransferWise also gives us local bank account details making the transaction easier and faster for both parties.

Opening a Foreign Currency Account

Many banks also provide the possibility to open a foreign currency account, eliminating the need for exchanging currencies at all.

Some examples where this is beneficial:

- You plan on spending money in dollars. You could spend the money without converting it at all.

- The exchange rate is bad and you want to wait with exchanging it until the rate improves.

- You live in a country with a volatile currency and you want to keep some of your cash in a more stable currency to decrease your exposure to currency fluctuations.

In those cases it's worth seeing if your bank offers this and how much it costs.

What to Do Next

Since everyone's situation is different I can't say which banks or payment providers are the cheapest in your situation but you now have to knowledge to evaluate this yourself.

Look up your bank's exchange rate and compare it to the mid-market exchange rate you'll find on XE and Reuters. How much markup have they added? What other fees do they charge on international payments you receive?

Once you know the numbers for your own bank you can compare them to well-known online payment providers and see what's best in your situation. Here are some other ways to accept payments for remote freelancers with their pros and cons to help you figure out which one fits best in your situation.

ps. If you'd like to join TransferWise and get a free international transfer you can use my affiliate link.